Key Points to Keep in Mind

- Boosting your outdoor area can significantly enhance curb appeal, increase usable space, and elevate the home’s overall atmosphere.

- Investing heavily isn’t always the answer—routine lawn upkeep and preserving existing features often pay off better.

- While neighbors’ upgrades influence your home’s value, prioritize your own lifestyle needs when planning renovations.

- Home equity loans and HELOCs offer cost-effective ways to fund substantial outdoor transformations.

As spring approaches—the season traditionally signaling the start of house-hunting—the urge to refresh the outdoor environment takes hold of many homeowners. According to a recent poll from real estate network HomeLight, and echoed by Mallory Micetich, a seasoned home consultant at Angi, “Landscaping enhancements consistently deliver strong returns by elevating both curb appeal and the ambiance of your surroundings.”

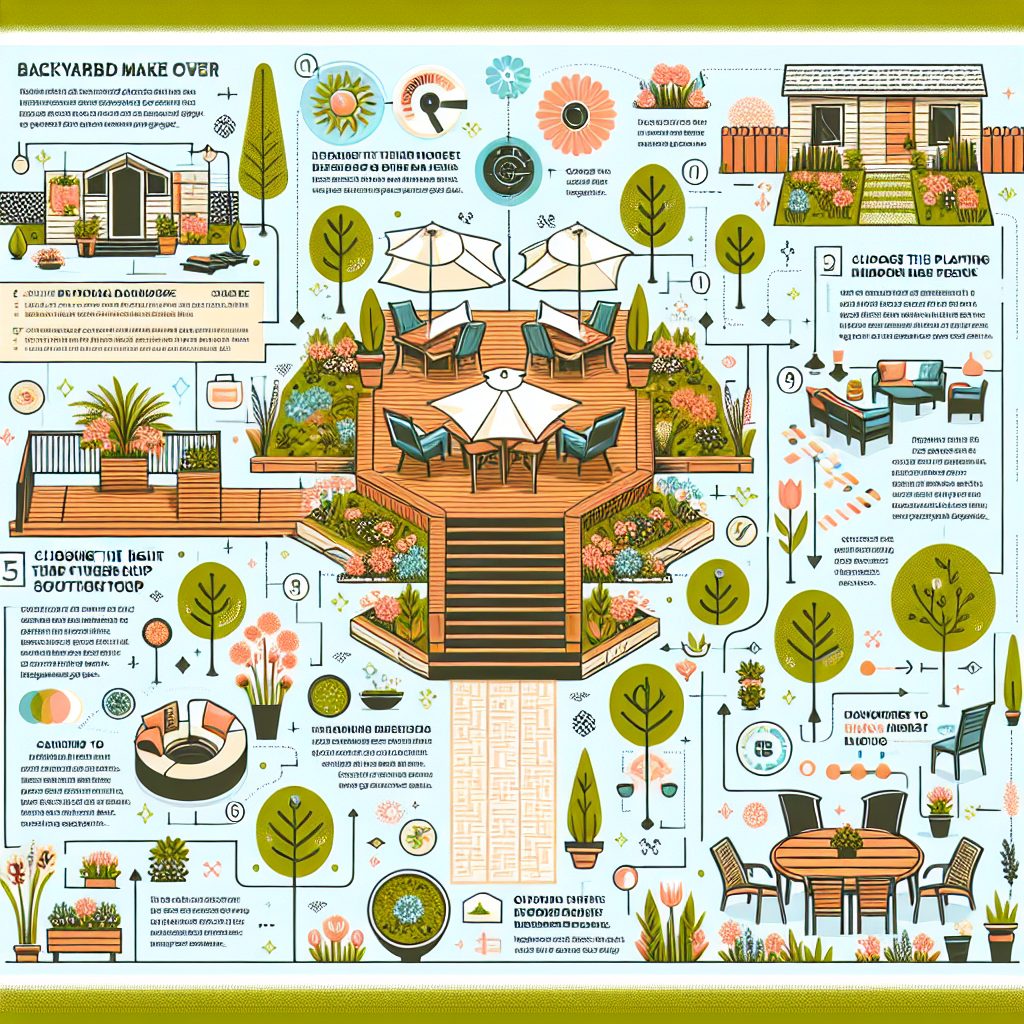

Transforming your backyard doesn’t just enrich your living experience; it also has the potential to vastly increase your property’s market value. Yet, amid soaring prices, it’s tempting to overspend. However, grand scale upgrades aren’t necessarily the smartest route. Thoughtful strategizing and solid homework are crucial to squeezing the most bang for your buck in outdoor renovations. The following five pointers will guide you through the process of planning an upscale yard revamp.

Backyard Renovation Market Snapshot

| Pool Installation | $39,000 – $70,000 |

| Deck Construction | $4,200 – $11,900 |

| Patio Installation | $2,000 – $5,800 |

| Landscaping and Garden Work | $100 – $6,000 |

| Fence Installation | $1,750 – $4,500 |

1. The Power of Basic Lawn TLC

Getting the most value without draining your wallet? Start small with essential landscaping chores. Lisa Schaumann Stryker, Vice President of Marketing & Communications at the National Association of Landscape Professionals, stresses, “A vibrant lawn paired with well-kept flower beds, crisp edging, and fresh mulch can dramatically uplift your yard’s appeal on a shoestring budget.” Other wallet-friendly fixes include pruning unruly hedges, clearing dead foliage, fixing sprinkler systems, and giving the overall space a refreshed, groomed look.

Realtors frequently advocate for straightforward yard maintenance before putting a home on the market, as outlined by the National Association of Realtors (NAR). William—a home valuation expert—notes, “The focus isn’t on flashy materials but the general upkeep when assessing a property. Even if you have brick over concrete, which is pricier, the condition commands respect more than the material itself.”

When selecting materials, do your homework by comparing prices to ensure every dollar stretches further. Splurging only makes sense if the investment promises durability and lowers repair frequency.

2. Keep an Eye on Your Neighbors’ Upgrades

Neighborhood trends heavily shape how properties are appraised. Sometimes conforming to communal standards is vital to avoid diminishing your home’s worth. William points out, “In upscale communities where pools are de rigueur, lacking one—even if it costs $68,000 with hardscape—can lead to a lower sale price.”

However, there’s no need to outshine the block extravagantly. Overindulgence in the swankiest and most costly materials might not translate into better returns. Buyers crave modernity but don’t necessarily seek opulence.

3. Tailor the Space to Your Day-to-Day Needs

Before embarking on any overhaul, homeowners ought to envision how they’ll actually live in their outdoor oasis. Schaumann Stryker advises breaking the yard into zones for various activities, such as play areas for kids and pets, spots dedicated to entertaining guests, or quiet nooks for relaxation. “Functionality is king when it comes to outdoor living, so designing with purpose should top your list,” she adds. Even if pools aren’t universally appealing to buyers, versatile features like patios are growing in popularity, as NAR’s outdoor remodeling report confirms.

4. Financing Your Big Outdoor Dreams

While some weekend warrior projects can be tackled solo, hefty renovations typically call for monetary backing. For those with considerable home equity, tapping into home equity loans or lines of credit (HELOCs) can provide affordable funding options. These often come with lower interest rates compared to standard personal loans.

Jon Giles, senior VP of residential lending at TD Bank, shares, “Although interest rates have climbed, borrowing against your home remains a cost-effective borrowing strategy. Given that average remodels hover around $45,000, home equity financing is a popular choice for many.”

Do keep in mind, however, that these loans add debt secured by your property. Falling behind could jeopardize your home, so assess your financial resilience before proceeding.

Popular Backyard Trends Gaining Ground

- Swimming Pools: While pools add a lively vibe to any backyard, they may deter some buyers due to upkeep concerns. Micetich highlights that pools yield approximately a 66% return on investment, translating to an added resale value in the ballpark of $8,500 to $9,300, per Remodeling magazine’s latest “Cost vs. Value” analysis. Wood decks, albeit requiring more maintenance, tend to offer better returns due to lower initial costs.

- Patios: According to HomeLight’s survey data, patios continue to be a hot favorite, maintaining strong growth rates over several years as a versatile enhancement.

- Outdoor Kitchens: Going far beyond a simple grill, outdoor kitchens equipped with sinks, refrigerators, and storage space are highly sought-after. Valued at roughly $15,000, these setups can recoup their investment fully, as noted in NAR’s “Outdoor Features” report.