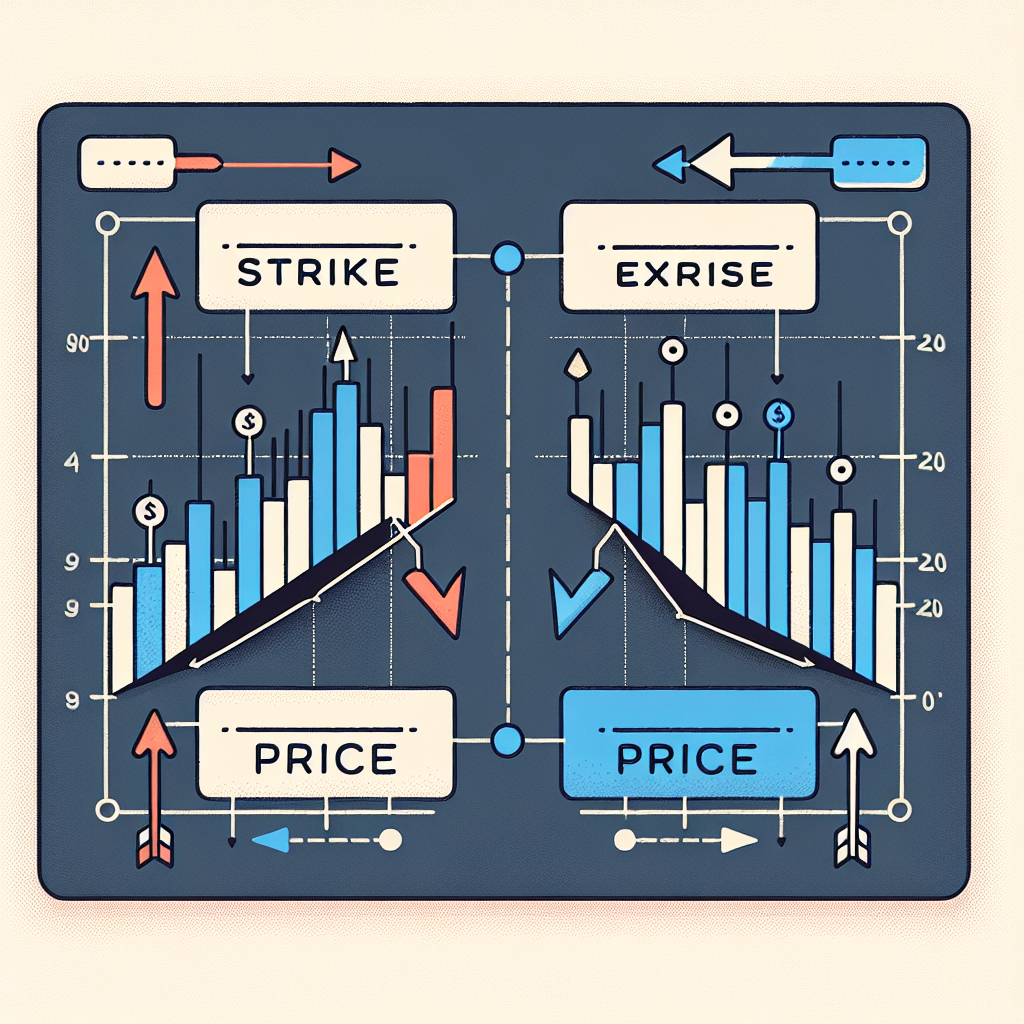

Both strike price and exercise price name the predetermined level at which you have the option to buy or sell the underlying asset. These terms are often tossed around interchangeably by investors, referring to the locked-in price from the moment the option is acquired. Yet, a single security can sport a variety of options, each flaunting its own unique strike (or exercise) price.

Unpacking the Meaning Behind Strike and Exercise Prices

To get a grip on what these prices represent, we first need to break down the concept of options themselves. An option grants the holder the privilege, but not the binding duty, to trade a security — be it stocks or other assets — at a specified price before a deadline. Traders often dive into options markets aiming to juice up their profits or shield against losses, but if these options expire unused, they turn worthless.

How Strike Price Interacts with Trading Options

In options trading, the strike or exercise price dictates the exact price at which you can execute the purchase or sale of the underlying asset. Once you put this right into action, it’s known as “exercising” the option. Whether you hear “strike price” or “exercise price,” both point to that critical figure embedded in your option contract.

Options come primarily in two flavors: calls and puts. The marketplace can list dozens or even hundreds of contract variations, each tied to differing strike prices and expiration dates, making it a dynamic puzzle. This variety means that at any given moment, several options may be classified as “in the money” or “out of the money,” depending on the underlying asset’s current price.

The Distinction Between Strike Price and Premium

It’s crucial to underline that the strike price shouldn’t be mistaken for the option’s purchase cost itself — known as the premium. For example, an option with a $50 strike price might carry a premium of $1 per share. Considering a standard options contract usually covers 100 shares, the premium totals $100. When calculating possible profits, subtracting this premium cost from your gains is essential for an accurate assessment.

Quick Fact Corner

Options trading volume can be staggering. According to recent market data, daily option contracts traded in U.S. equities often exceed 30 million, reflecting investors’ appetite for leveraging their strategies through calls and puts at varied strike prices and expirations.

Why Options Can Be an Attractive Play

For savvy market participants, options offer a compelling avenue to amplify returns or build hedges. Their versatility and leverage can unlock significant profit potential but always come paired with elevated risk if not handled prudently.

Investment Advisory

Disclaimer: It is highly recommended that all investors diligently perform their own thorough research when exploring various investment approaches. Keep in mind, previous product performance does not guarantee any future success or price increases in the markets.